Bad Credit Home Loans and Investment Loans

Rejected by the Banks, poor credit history, can't get a loan?

A poor credit history occurs when an individual has not made credit or utility payments and the lender or supplier makes steps to have this listed on your credit report.

You can access your credit report from Veda Advantage. You can access this for free, however, if you are impatient it can be dispatched within one working day for a fee.

Getting a Loan

A poor credit history severely impacts your chances of getting a loan. Minor credit defaults under a $1,000 may be over looked by some lenders but anything more requires a satisfactory explanation. All creditors must be paid before any lender will consider accepting a loan application

Therefore, if you are unable to get a loan because of;

poor credit history

poor employment history

previously bankrupt or Part 9 or 10 agreement

However, there is still hope in obtaining a loan.

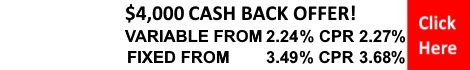

Interest Rates and Fees

Interest rates and fees depends on the level of your credit history. Typically, the poorer the credit the higher the interest rate. This depends on the following;

Number of defaults held against your name

The type of those defaults against your name. Utility defaults are looked more favorably compared to finance defaults such as credit card or loan defaults.

The dollar amount of the defaults. Generally, the higher the default, the higher the risk or interest rate

The greater the deposit the lower the interest rate

Mortgage arrears

Advantages

Gives the borrower a chance to improve their credit rating by allowing the opportunity to service a new loan.

Non judgmental lending rules.

Disadvantages

Interest rates and fees are high.

Require larger than normal deposit or equity.