100% Offset Account Home Loans

Pay your loan sooner by reducing the amount of interest you pay over the life of the loan...

This is a separate account linked to your loan that operates like a normal bank account where salaries go in and funds come out via cheque book, ATM or EFTPOS. The savings in this account theoretically reduces the total loan amount and therefore lower interest is paid.

What to look for

Partial offset accounts where they may offset the loan at normal savings rates. In this case it may be better to make extra repayments into the loan account.

Added fees and charges associated with offset accounts.

Offset accounts that act like your ever day transaction account

Some lenders offer 100% offset for fixed rate loans

Advantages

Can be used like an everyday bank account with access to an ATM card or cheque book

Savings in the account reduces the interest paid and the term of your home loan

Interest savings are not taxed

Very convenient

Pay off your loan sooner by offsetting the interest on your loan and save on interest payments.

Disadvantages

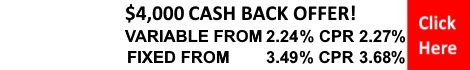

Usually there are extra costs associated with offset accounts such as expensive ongoing fees and higher interest rates. However, some lenders offer very favourable terms.

Most fixed rate loans do not come with mortgage offset

Partial offset accounts are not advantageous

Alternatives to offset accounts

Basic home loans can offer similar benefits to loans with offset accounts. Some basic home loans offer a low interest, low or nil ongoing fees and a free redraw facility. The only draw back is that you do not have the convenience of a separate account.

Line of Credit Loans also offer similar advantages but again you have to find a loan with low rates and ongoing fees